Huntington Beach Bankruptcy Attorney

Does bankruptcy scare you? Are you aware that millions of debtors and businesses have filed bankruptcy and found considerable relief from extreme debt and anxiety? And that they later found considerable success in their private and business affairs? This is all because they took the initiative to legally discharge debt that and begin anew. You can take the first step by calling a Huntington Beach bankruptcy attorney at (888) 754-9877.

A Huntington Beach bankruptcy attorney will advise you of the bankruptcy options that apply to your financial situation. Chapter 7 can discharge unsecured debt. A Chapter 13 can help Huntington Beach homeowners avoid foreclosure and repay creditors over time. Chapter 11 is for businesses who need time to pay creditors, adjust debt and reorganize. All require the advice of a Huntington Beach bankruptcy attorney whom you should consider having represent you.

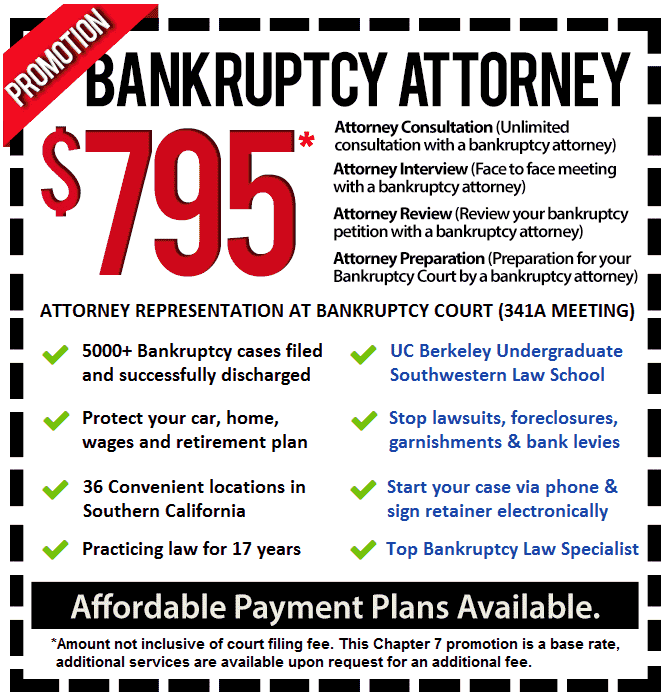

Call a Huntington Beach bankruptcy attorney and schedule a consultation about how your financial circumstances could dramatically improve in a short time.

Chapter 7 Bankruptcy

Debtors and Huntington Beach businesses who are stifled by severe debt problems can cancel business debts as well as debt like credit card charges, medical bills, department store bills, personal loans, promissory notes, business debt, payday loans and deficiencies from repossession.

Individuals must have their eligibility to file confirmed by a Chapter 7 Bankruptcy Lawyer. Your assets will also be examined by a Chapter 7 Bankruptcy Lawyer for exemptions. You will also be required to meet certain obligations that a Chapter 7 Bankruptcy Lawyer will ensure compliance.

Your only appearance is with the trustee to review the petition of your financial affairs prepared by the Chapter 7 Bankruptcy Lawyer. This is routine meeting where your Huntington Beach bankruptcy lawyer will accompany you. Most cases are discharged about 4 months after filing.

Chapter 13 Bankruptcy

If your Chapter 13 Bankruptcy Attorney advises that your income exceeds the criteria for filing Chapter 7, you may elect Chapter 13. A Chapter 13 Bankruptcy Attorney prepares a repayment plan to pay back secured and other priority creditors over 3 years but up to 5 years in some cases. By filing, your Chapter 13 Bankruptcy Attorney can see that any foreclosure or repossession activities are halted.

The Chapter 13 Bankruptcy Attorney can also adjust secured debt to its market value for inclusion in the plan. Huntington Beach sole proprietors can include business debt if they personally guaranteed it.

Debtors make a single monthly payment to a trustee. Your Huntington Beach bankruptcy lawyer will also include arrearages for a mortgage, auto, student loan or court ordered support payments in the plan.

Chapter 11 Bankruptcy

Huntington Beach businesses struggling with heavy debt may be forced into Chapter 11 by creditors or voluntarily file. A Chapter 11 Bankruptcy Lawyer will prepare a reorganization plan for creditors whose debts will be adjusted who will vote to confirm or reject the plan. The plan submitted by the Chapter 11 Bankruptcy Lawyer will include a restructuring plan as well to get the company back on its feet.

In Chapter 11, a company retains control over its assets and normal operations. A Huntington Beach bankruptcy lawyer will ensure the company meets its filing and reporting obligations and pays the costs and other fees associated with the case. Business decisions that materially affect the business have to be court-approved.

Smaller businesses and individuals who wish to file after consultation with a Huntington Beach bankruptcy lawyer can avoid some of the formalities of the process though they will be subject to greater monitoring by the court.

Call a Huntington Beach bankruptcy lawyer at (888) 754-9877 and take the initiative to getting your life or business back on track to future success.