Westminster Bankruptcy Attorney

When extreme debt overwhelms your finances or impedes the success of your business, consider calling a Westminster bankruptcy attorney at (888) 754-9877.

Most individuals who file bankruptcy do so because of an unforeseen event such as loss of a job or a serious illness or injury. A Westminster business might be suffering from an unfortunate business decision or series of lawsuits. Regardless, you can benefit from bankruptcy in certain circumstances by being relieved of debt and starting anew with assistance from a Westminster bankruptcy attorney.

Bankruptcy is for individuals and businesses. In straight bankruptcy, you can wipe out business and consumer debt but may have to surrender assets to pay off creditors. Consumers can retain personal assets through available exemptions. Other alternatives are repayment proceedings under Chapter 13 for individuals and Chapter 11 for businesses. A Westminster bankruptcy attorney can advise you on these options.

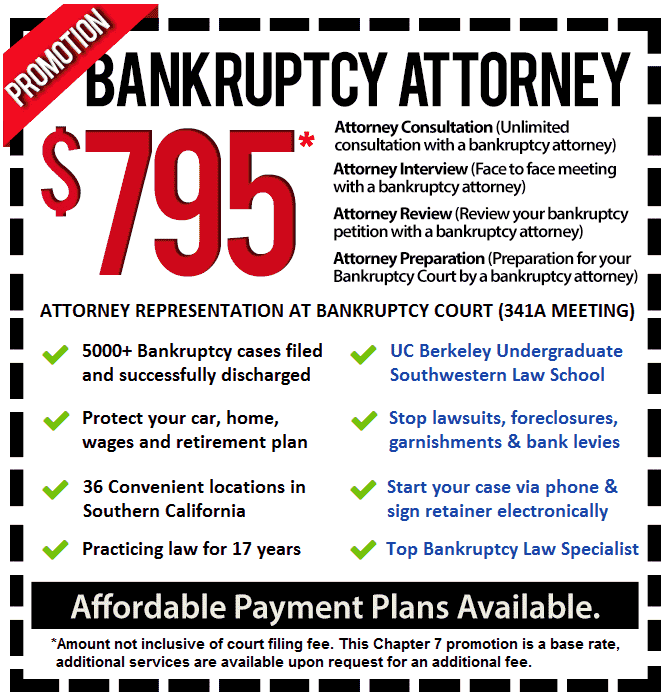

If you are considering bankruptcy, schedule a consultation with a Westminster bankruptcy attorney.

Chapter 7 Bankruptcy

Under Chapter 7, debtors can erase debt like credit card charges, medical bills, department store bills, personal loans, promissory notes, business debt, payday loans and repossession deficiencies. Consumers have to qualify to file if a Chapter 7 Bankruptcy Lawyer confirms their income meets certain limits. The Chapter 7 Bankruptcy Lawyer also has to assess your personal assets for exemptions or face their loss to the trustee.

Once you satisfy certain obligations that a Chapter 7 Bankruptcy Lawyer will confirm, the Chapter 7 Bankruptcy Lawyer will file a petition of your finances that is later reviewed by a trustee at a 341a Meeting with you and your Westminster bankruptcy lawyer. In most cases, a discharge is granted within the following 90 days.

Chapter 13 Bankruptcy

In some cases, a Chapter 13 Bankruptcy Attorney may advise you that Chapter 13 is only available or that it is preferable as it can help you retain assets that are at risk. A Chapter 13 Bankruptcy Attorney submits a plan for individuals or sole proprietors to pay back secured and priority creditors over 3 years in most cases. The Chapter 13 Bankruptcy Attorney can help Westminster residents avoid foreclosure or other property repossession by including arrearages in the plan and ensuring that individuals can keep up with current payments.

Most secured debt can be adjusted by a Chapter 13 Bankruptcy Attorney that can save Westminster consumers considerable money over the duration of the plan. Most unsecured debt will be discharged under this filing.

Chapter 11 Bankruptcy

If your Westminster business is struggling, have a Chapter 11 assess the feasibility of filing for reorganization under Chapter 11. This is a repayment process where a Chapter 11 Bankruptcy Lawyer adjusts certain debt under a reorganization plan submitted to certain creditors for confirmation.

Under the plan, a debtor company retains control of its assets and day-to-day operations. A Westminster bankruptcy lawyer makes sure the business complies with all reporting and filing formalities. Major decisions that directly affect the business such as selling major assets or equipment or re-negotiating current contracts have to be court-approved.

There is no time limits on a Chapter 11 though the court will monitor the company’s progress. Smaller businesses and even some individuals may file Chapter 11 upon advice by a Westminster bankruptcy lawyer.

Call a Westminster bankruptcy lawyer today for additional information about how bankruptcy could be a practical option to resolve your financial troubles.